Bridgement is built for speed and clarity in SME finance, turning slow cash flow into momentum with decisions in hours and funds that can land as soon as the same day.

Business Funding

In an environment where supplier discounts vanish, invoices drag to 30–90 days, and opportunities don’t wait, Bridgement gives South African businesses an agile way to draw capital, repay early, and pay less overall. The premise is simple: short, transparent, unsecured funding that tracks how SMEs really trade—quick cycles, clean dashboards, and no compounding surprises.

Overview

What Bridgement is (and isn’t).

Bridgement is a South African fintech that provides unsecured, short-to-medium-term funding designed for working capital rather than long-dated capex. It focuses on speed (digital application, data-driven decisions), simplicity (fixed, all-in costs), and flexibility (term loans, revolving credit, invoice finance, and trade credit). It is not an asset-finance provider for multi-year machinery purchases and not aimed at idea-stage startups with no trading history.

Who Bridgement serves.

SMEs with real revenue and short cash cycles: retailers before peak season, contractors bridging milestone payments, professional firms covering payroll while corporates pay on 60-day terms, hospitality operators stocking up, and light manufacturers buying inputs at discount. If cash timing is your biggest constraint, Bridgement is built around that reality.

Features

- Fast application & decisions: Apply online in minutes; approvals can follow within hours once data is verified.

- Funding up to R5,000,000: Limits scale with turnover and performance.

- Terms from 1–12 months: Short horizons mapped to trading cycles.

- Unsecured facilities: No asset collateral required (affordability and trading data matter most).

- Transparent, fixed costs: A single all-in finance fee per draw; no compounding interest.

- Early-settlement benefits: Repay sooner, pay less—no early-repayment penalties.

- Bank & accounting integrations: Share read-only feeds for faster, cleaner underwriting.

- Product breadth: Business Loan (term), Line of Credit (revolving), Invoice Finance, and BridgePay (trade credit).

Pricing (How the money really works)

Fixed-fee model.

Each draw or loan has one clearly stated finance cost, shown upfront with the total rand repayable—no surprise compounding, no trailing account fees. Because the fee is fixed, you can model cash flows precisely and immediately see whether the expected ROI beats the cost.

Typical structures (illustrative).

- Rates: Often positioned from short-tenor, low-risk scenarios upward; your actual quote depends on turnover patterns, sector, and term.

- Terms: 1–12 months. Term loans typically repay in equal instalments. Invoice finance can align to debtor payments.

- Early settlement: Clear early and receive a discount on the remaining scheduled cost. This is where disciplined users save the most.

Why SMEs like this pricing.

- Plannable cash flows (fixed, all-in costs you can pencil into forecasts).

- Savings for good behaviour (settle early, reduce total cost).

- “Pay only when you use it” dynamics on a revolving line.

Pro tip: Treat the fixed fee as the price of speed and certainty. If an 8% supplier discount, an urgent PO, or a must-hit marketing window yields more value than the fee, the funding is net-positive.

User Base & Eligibility

Baseline criteria (typical).

- Registered South African business.

- Trading history: ±6–12+ months (more history → higher limits).

- Annual revenue: commonly ~R500,000+ as a starting floor.

- Data: connect your bank/accounting software via secure read-only link or upload recent statements.

Great fits.

- SMEs with consistent turnover and occasional timing gaps.

- Seasonal businesses stocking up before peaks.

- B2B firms on 30–90 day terms that must cover payroll, inputs, or projects meanwhile.

Weaker fits.

- Pre-revenue or idea-stage startups.

- Heavy capex projects needing multi-year terms.

- Businesses without a clear plan to repay inside 12 months.

Advantages

- Speed: Decisions in hours; payouts can be same-day after acceptance.

- Clarity: Fixed, all-in costs shown before you sign.

- Flexibility: Revolving draws when needed; repay and redraw without reapplying.

- Unsecured: Keep assets free for other facilities.

- Data-driven: Bank/accounting feeds streamline underwriting.

- Early-settlement rewards: You’re incentivised to be prudent and pay down quickly.

Disadvantages

- Cost vs bank overdraft: Unsecured speed usually costs more than secured bank lines.

- Short tenor: 1–12 months suits trading cycles, not multi-year equipment.

- Revenue floors: If you’re well below ~R500k/year, qualification is unlikely (for now).

- Discipline required: Revolving credit can be overused—plan draws against real cash-in dates.

Safety & Trust

- Read-only data connections: Integrations provide visibility, not money-movement rights.

- POPIA-aligned practices: Encryption and access controls standardise data security.

- Transparent terms: Total cost is explicit before you accept.

- Early-settlement by design: No penalties for paying down early—evidence of a borrower-friendly posture.

Product Deep-Dive

Business Loan (Term Loan)

A once-off lump sum with a fixed, all-in cost. Repay in equal instalments over 1–12 months. Ideal for discrete projects—bulk inventory, urgent repairs, marketing pushes—that have a clear ROI timeline. Settle early to cut the remaining scheduled cost.

Best for: One-time needs with predictable payback (e.g., seasonal stock, a store refresh, campaign bursts).

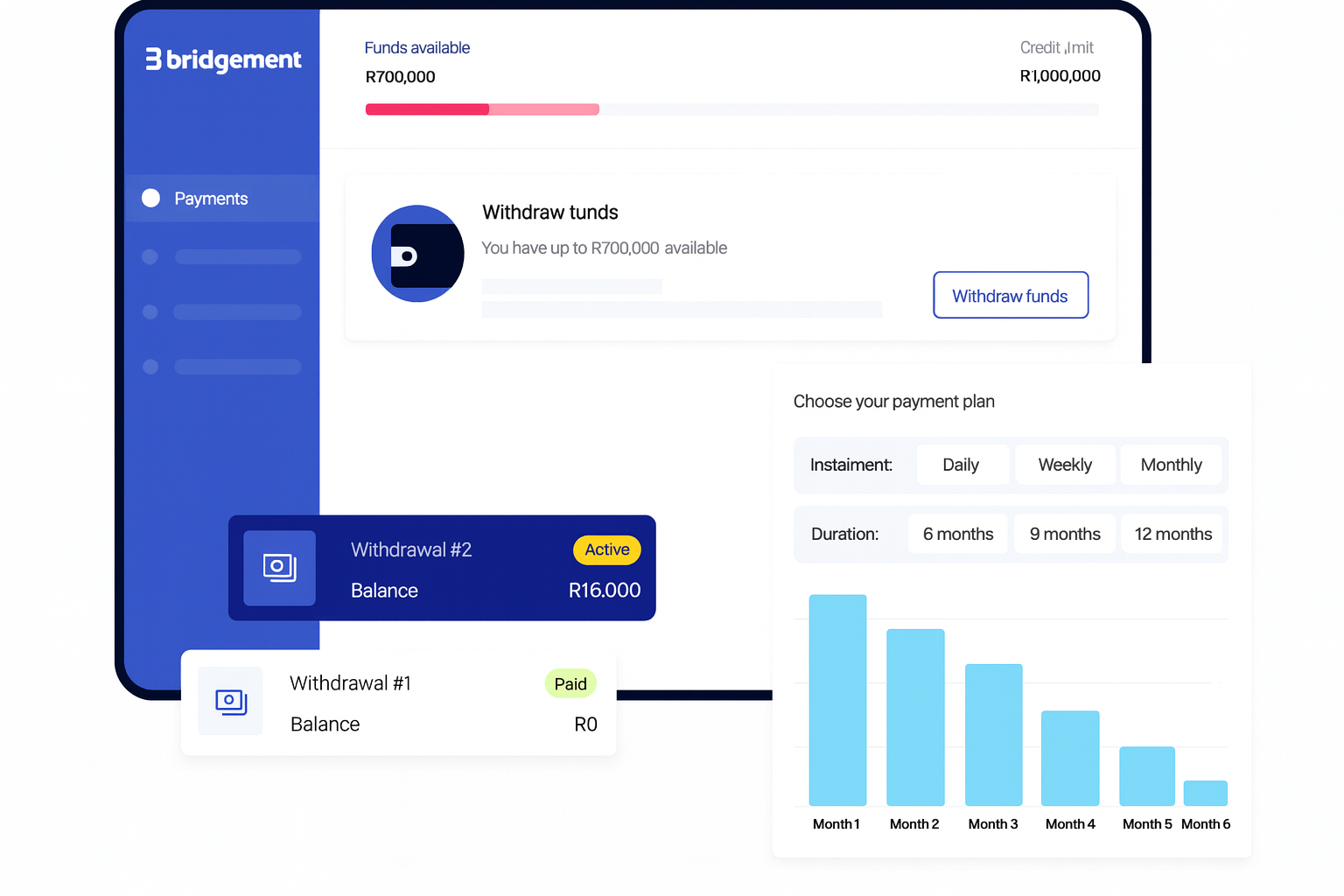

Line of Credit (Revolving Facility)

A limit you draw from as needed, repay, and redraw—without reapplying every time. You pay only on the portion you use. Great for repeated working-capital waves: supplier deposits, quick restocks, or bridging cash gaps between invoices.

Best for: Ongoing cash-cycle management with moving parts and frequent micro-decisions.

Invoice Finance

Advance against selected outstanding invoices. Pick one or many; repay when debtors pay or via a short schedule up to 12 months. Non-disclosed options keep client relationships simple.

Best for: B2B businesses on 30–90 day terms that still need to cover payroll, inputs, or growth tasks now.

BridgePay (Trade Credit)

Vendor-style working capital for inventory or input purchases, helping you lock in early-payment discounts and strengthen supplier relationships.

Best for: Inventory-driven businesses squeezing margin via bulk buys and early-pay deals.

Step-by-Step: How to Apply

- Apply online (2–5 minutes). Enter basic company info and funding need.

- Connect data. Link bank/accounting software read-only or upload recent statements.

- Get a quote. Review amount, term options (1–12 months), and total fixed cost.

- Accept digitally. E-sign; no branch visits or in-person meetings.

- Get funded. Funds can land quickly; track activity in your dashboard.

- Repay early when possible. Reduce cost, unlock capacity, and—if on a line—redraw when needed.

Documentation that helps:

- Clean bank feeds (steady turnover, few unpaid debits).

- Management accounts and VAT submissions (boost confidence and limits).

- Debtor/creditor age analyses (especially for invoice finance).

Examples & Use-Cases

Retail: Pre-season stock

A boutique draws R600k from its line at a wholesale discount, sells through peak, settles in month 3, and reopens capacity for Easter. The discount plus early-settlement savings beat the finance fee.

Construction: Progress-payment gap

A contractor takes a 6-month term loan to cover materials and payroll. The milestone certificate pays in month 4, they settle early, and the saved cost enhances margin.

Professional Services: 60-day corporates

A design agency advances R300k in invoices to pay staff and software. When the client pays in 45 days, the facility clears and becomes available again for the next cycle.

Hospitality: Menu refresh & refurb

A café uses BridgePay to kit out a kitchen refresh and buy inputs at discount. Daily takings cover short-tenor instalments while the facelift drives higher spend.

Comparisons & Alternatives

- Lula (ex-Lulalend): Similar speed with a strong revolving facility and early-settlement savings; also offers a business account.

- Retail Capital / Merchant Capital: Turnover-linked advances (great for card-heavy retail/hospitality) with repayments as a % of daily swipes.

- GENFIN / Payabill: Useful when supplier payments and trade terms are the bottleneck.

- Banks (overdraft/term loan): Cheaper if approved, but slower and collateral-heavy.

- Public DFIs (SEFA / NEF / IDC): Better for larger, longer projects with development mandates; deeper documentation and timelines.

When Bridgement shines

- You prioritise speed, clarity, and short-term flexibility.

- You can settle early thanks to fast stock turns or predictable debtor inflows.

- You want invoice-by-invoice control, often without disclosing to clients.

When to choose something else

- You’re buying heavy machinery (asset finance beats short-tenor working capital).

- You can secure a large, cheap overdraft with collateral and time to spare.

- You’re pre-revenue (build trading history or explore grants/incubation first).

Actionable Playbooks (Quick Wins)

- Supplier-discount arbitrage: Use a short draw to unlock an early-pay discount > finance fee. Settle the facility from the improved margin.

- Invoice-timing bridge: Fund the slowest 10–20% of invoices, not all—target the drag that hurts most.

- Cycle discipline: Fix a rule (e.g., no draw without a written payback plan tied to a cash-in date).

- Limit hygiene: Keep the line small enough to respect, large enough to be useful. Request increases only after two clean cycles.

- Early-settlement habit: Schedule fortnightly reviews to pre-pay whenever cash is ahead of plan.

FAQs

- What is Bridgement?

A digital funder providing South African SMEs with unsecured working-capital solutions: term loans, revolving credit, invoice finance, and trade credit. - How much can I get?

Facility sizes typically range from about R20,000 up to R5,000,000, subject to turnover and risk. - How fast is funding?

Applications take minutes; approvals can arrive within 24 hours once data is verified, with payouts shortly after acceptance. - Do I need collateral?

No. Facilities are unsecured, although affordability checks and standard guarantees may apply. - What are the terms?

1–12 months, aligned to short trading cycles. Invoice finance can sync to debtor payment timing. - How is pricing structured?

A fixed, all-in finance cost per draw or loan. The total rand repayable is shown upfront. - Can I repay early without penalties?

Yes. Early settlement reduces the remaining scheduled cost. - Who qualifies?

Registered SA businesses with ~6–12+ months of trading history and around R500k+ annual revenue are typical baselines. - How does invoice finance work?

Select specific invoices to advance. Repay when the client pays or via a short schedule; non-disclosed options are available. - Will clients know I’m financing invoices?

Not necessarily—non-disclosed structures can keep funding invisible to the debtor. - How are limits decided?

By analysing bank feeds, accounting data, revenue consistency, sector risk, debtor quality, and payment behaviour. - Are there hidden fees?

No. Quotes display the total cost before acceptance; no compounding or monthly account fees. - Can sole proprietors apply?

Yes, if the business is registered, actively trading, and meets baseline thresholds. - What happens if I struggle to repay?

Contact support early. Restructuring options are easier before arrears escalate. - Is Bridgement good for startups?

If you’re pre-revenue, it’s better to build trading history or explore grants/incubators first; revisit Bridgement once revenue is stable.

Final Verdict

Bridgement is a crisp, technology-first answer to short-term SME funding: fast decisions, transparent fixed fees, product flexibility, and real savings for early settlement. It won’t undercut a secured bank overdraft on price, but it wasn’t built for that—it was built for SMEs that need certainty, speed, and control without weeks of paperwork or collateral. If your cash cycle is tight, client terms are long, and supplier opportunities are time-sensitive, Bridgement deserves a top-three spot on your funding shortlist. For South African businesses that run on rhythm and responsiveness, Bridgement can be the difference between missing a window and making it—today, not next quarter.