Swoop Funding turns capital-hunting into a streamlined search. Swoop Funding connects SMEs to loans, grants, equity, and savings products through one profile—cutting noise, surfacing fit, and helping owners compare options fast. In a market where time, paperwork, and price decide competitiveness, that single interface can be the edge.

Business Funding

For founders who want less friction and more execution, Swoop Funding acts like a smart broker plus dashboard. It collects business data once, matches across multiple funders and products, and flags the small details that actually move approvals: contract proof, banked turnover, security clarity, and cash-flow logic. This review breaks down how Swoop Funding works, what it costs, who should use it, and how to combine it with banks, DFIs, and incentives for a resilient funding stack.

Overview

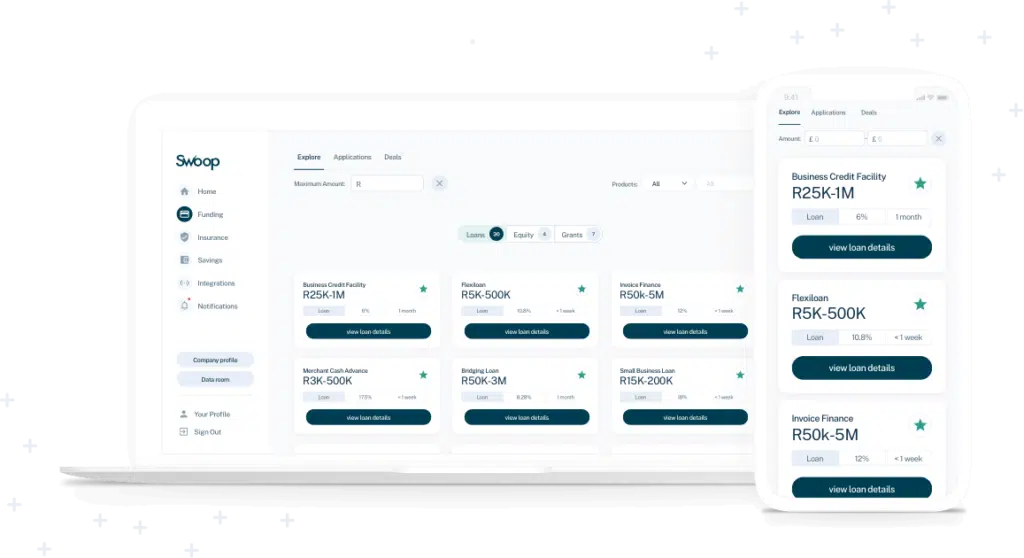

Swoop Funding is a funding marketplace and matching platform for SMEs. Instead of knocking on ten doors with ten different application packs, owners build one profile and get curated options across debt, equity, grants, and even cost-saving tools (like banking or energy switching in some markets). The value is in speed and fit: you see what’s realistically achievable, at what likely price, and with which documents.

What makes Swoop Funding useful to operators

- Single intake, multiple matches: One profile, many lenders/investors, fewer repeated KYC loops.

- Funding spectrum: Working capital, asset finance, invoice/trade finance, property, growth loans, equity connects, and relevant grants.

- Evidence-first UX: Nudges for the documents that improve pricing and approvals (bank statements, POs, management accounts).

- Comparison power: Estimated rates/fees and terms side-by-side so owners can choose on total cost, not just headline APR.

- Signals & support: Humans plus software—advisory touchpoints for structure, eligibility, and timing.

Bottom line: Swoop Funding is not “free money.” It’s a faster route to realistic options—provided your numbers are tidy and your demand is provable.

Features

Swoop Funding is built for practical use-cases—smoothing cash cycles, adding equipment, opening sites, or bridging orders.

- Debt marketplace: Term loans, overdraft-style lines, revenue-based options (where available), asset/vehicle finance, and property-backed facilities.

- Trade & invoice tools: Convert approved invoices or POs into cash; align repayments to customer terms.

- Equity connections: Where growth warrants it, link to investors who fit stage and sector.

- Grants & incentives finder: Surface relevant programmes and outline the evidence needed to claim.

- Smart document vault: Store statements, management accounts, quotes, contracts, insurance, and compliance—ready to dispatch.

- Cost-saving switches (selected markets): Bank account, energy, or FX setup to improve margins and cash runway.

- Human help where it matters: Support for structure (security, tenor, tranching), plus readiness checks before you burn time.

How a typical journey flows:

- Build profile → 2) Connect bank/transact data → 3) Upload essentials → 4) See matches & pre-eligibility → 5) Shortlist and apply → 6) Close, draw, and track.

Pricing

Swoop Funding itself doesn’t lend; its economics usually come from referral/arrangement models with lenders or via advisory/switching fees. Some offers may show an arrangement fee or broker fee; lender-side initiation/legal/admin fees still apply.

What to expect in practice (illustrative):

- Platform use: Often free to start; fees arise when you take a product or request premium help.

- Lender costs: Initiation, legal, valuation/registration for assets/property; interest is risk-based.

- Broker/arrangement fees: Sometimes part of the offer; look for the all-in number.

- Equity: No interest cost; dilution and legal fees apply.

- Grants: No interest; but they’re reimbursive or milestone-based—cashflow planning still required.

How to lower your effective cost:

- Present contracted demand (POs/frameworks) and clean statements.

- Match tenor to asset life (no 48-month loan for 18-month equipment).

- Keep insurance and registers current (cheap risk reduction → better terms).

- Model a conservative base case with DSCR buffers and seasonality.

User Base

Swoop Funding suits SMEs that can convert capital into cash predictably and want options without endless form-filling.

- Retail & e-commerce: Preload inventory ahead of peak demand.

- Services & contractors: Bridge upfront costs on milestone jobs.

- Manufacturing & agro-processing: Finance a new line, mould, or toolset.

- Transport & field ops: Add vehicles/equipment with route-backed revenue.

- Franchise & multi-site: Roll out locations with known payback profiles.

- Scale-ups: Blend debt with equity where growth outpaces cash.

Example (hypothetical): A catering supplier secures a national stadium contract. Swoop Funding surfaces an asset facility for cold-chain vehicles and an invoice line for 45-day terms. First principal begins after the stadium pays; DSCR stays healthy; supplier discounts improve once facilities are in place.

Advantages

The power of Swoop Funding is acceleration with discipline.

- Speed to suitable options: Cut weeks of outreach into hours.

- Breadth: Debt, equity, grants in one funnel—plus savings that widen margin.

- Evidence prompts: The right docs, in the right order, for sharper terms.

- Transparent comparisons: Choose on total cost and fit, not glossy headlines.

- Human + software: Guidance on structure, security, and timing increases close rates.

Disadvantages

Trade-offs to plan for:

- Not a lender: Outcomes depend on your business quality and the lender’s criteria.

- Data sharing: You’ll connect bank data and upload documents—use secure channels only.

- Fees vary: Broker/arrangement and lender fees differ across offers—check the all-in cost.

- No magic for weak files: If cash flow is thin or compliance is messy, matches won’t fix fundamentals.

Safety (Governance, ESG & Everyday Discipline)

Funding compounds when operations are tight.

- Separate business account and monthly management accounts (P&L, cash-flow, age analysis).

- Compliance current: Registration, tax, UIF/COID (if employing), relevant permits.

- Insurance & asset registers: Serial numbers, policy details, renewal dates—linked to financed items.

- Evidence trail: Quotes, invoices, proof of payment, delivery notes, commissioning photos.

- Covenant calendar: Report on time; flag risks early to maintain flexibility.

Swoop Funding vs Alternatives

Use Swoop Funding when you want breadth and speed without diluting quality. Go direct to a single bank when you’ve already got a deep relationship and a clear ask. Choose niche financiers when you have a single, well-bounded need (e.g., only invoice discounting).

Comparison Table — Swoop Funding vs Alternatives

| Option | Best For | Swoop Funding Edge | Where Others Win |

|---|---|---|---|

| Swoop Funding | Multi-product search & comparison | One profile → many matches; grants & equity too | Not a lender; outcomes depend on your file |

| Direct bank | Known, collateralised needs | Lower relationship friction; bundled services | Narrower product view; slower if docs messy |

| Asset finance house | Vehicles/machines only | Niche speed on serialised assets | Single-need focus; limited working capital |

| Invoice financier | Turning invoices/POs to cash | Fast liquidity on approved trade | Pricey if used as long-term working capital |

| Equity platform | Big growth plans | Non-debt capital; advisory fit | Dilution; longer timelines |

| Grant portal | Non-repayable support | Low effective cost | Reimbursive/admin heavy; slow payouts |

Eligibility (What Improves Your Matches)

- Provable demand: Signed POs/framework agreements, repeat revenue, or banked turnover.

- Cash-cycle logic: Clear link from funding → delivery → invoice → payment → instalment.

- Security & controls: Assets to register/insure; debtor cessions where appropriate.

- Governance basics: Separate account, clean statements, simple monthly reporting.

- People & process: Named owners for sales, delivery, invoicing, collections, and reporting.

Application Journey (Step-by-Step)

- Create & connect: Build profile; connect bank feeds where supported.

- Upload essentials: 6–12 months statements, management accounts, POs/contracts, supplier quotes (serials/specs).

- See matches: Filter by price range, tenor, security type, and speed.

- Shortlist & prepare: Fix gaps (insurance, registers, compliance) before pushing apply.

- Apply & engage: Expect KYC, affordability checks, security setup, and conditions precedent.

- Close & draw: Draw in stages if equipment/fit-out; align first principal with cash-in.

- Operate & report: Keep to covenants; update dashboard; re-price when performance improves.

Common Mistakes (and Fixes)

- Treating orders as cash → Align instalments to payment terms, not invoice dates.

- Thin evidence → Banked sales, POS exports, and signed POs beat verbal promises.

- Off-mandate spend → Stick to approved use; keep delivery notes and photos.

- Ignoring seasonality → Build buffers; shape instalments around slow months.

- Messy files → One cloud folder, clear filenames, monthly updates—treat it like a data room.

Actionable Checklist (Copy-Paste)

- One-pager: business model, funding need, sources & uses, payback logic.

- 6–12 months bank statements + latest management accounts.

- Contracts/POs or sales history; customer payment terms in writing.

- Supplier quotes with serials/specs; delivery & installation plan.

- 12–24-month cash-flow with grace/ramp logic and DSCR view.

- Security & insurance pack (registers, policies, renewal dates).

- Compliance file (registration, tax, permits).

- Reporting cadence (monthly bank rec + sales snapshot + covenant dashboard).

FAQs

01. What is Swoop Funding in practice?

A funding marketplace and matching platform that connects SMEs to debt, equity, grants, and savings via one profile and curated options.

02. Is Swoop Funding a lender?

No. It’s a broker/marketplace. Lenders set pricing/terms; Swoop Funding helps you find and compare them efficiently.

03. How fast can I get financing?

Speed depends on file quality, product type, and security. Clean statements, signed contracts, and prepared registers move fastest.

04. What products can I expect to see?

Term loans, overdrafts/revolving lines, asset/vehicle finance, property-backed facilities, invoice/trade finance, equity connections, and relevant grants.

05. Are there fees to use Swoop Funding?

Often free to start. Some offers include arrangement/broker fees; lenders also charge initiation/legal/admin. Compare all-in cost.

06. Will Swoop Funding hurt my credit score?

Soft pre-eligibility checks typically don’t; formal applications may trigger hard checks—standard across lenders.

07. Can repayments match my seasonality?

Many lenders allow seasonal or milestone structures if evidence supports it. Use the platform to filter for fit.

08. What improves approval odds the most?

Verifiable demand, practical security, conservative cash-flow modelling with buffers, clean account conduct, and a tidy evidence bank.

09. Can I combine debt with grants or equity?

Yes—common with expansion or long working-cap cycles. Swoop Funding can surface each layer.

10. What documents will I need?

Bank statements, management accounts, POs/contracts, supplier quotes with serials/specs, insurance, compliance certificates, and asset registers.

11. Do I get one offer or many?

You’ll see a shortlist of potential matches. Shortlist further on price, tenor, security, and speed, then apply.

12. What if my customer pays late?

Communicate early; use buffers; seek a short-term cure. Align future instalments to observed payment behaviour.

13. Can startups apply?

Yes—especially with signed contracts or verifiable early traction. Operating history and collateral improve outcomes.

14. How do I avoid over-borrowing?

Match tenor to asset life, keep DSCR comfortable, and stress-test for slower sales or higher input costs.

15. When should I refinance?

After 6–12 months of strong conduct, request re-pricing or better terms. Performance + tidy reporting = bargaining power.

Final Verdict

For owners who value speed, choice, and clarity, Swoop Funding earns a spot on the shortlist. It won’t do the heavy lifting of governance for you—but it will surface viable debt, equity, and grants quickly so you can choose the best fit and get back to work. Arrive with clean numbers, proof of demand, and a payment plan that mirrors your cash cycle, and Swoop Funding becomes more than a marketplace—it becomes the fastest path to a funding stack that actually works.