Lula is redefining SME finance in South Africa, combining lightning-fast funding with digital banking tools. Where traditional banks can take weeks to decide, Lula promises approvals in minutes and pay-outs in as little as 24 hours.

Business Funding

For SMEs that need to restock, bridge invoice gaps, or seize supplier discounts, that kind of speed is more than convenience — it can be survival. Lula pairs on-demand funding with a modern business bank account, creating a package that helps entrepreneurs stay in control of their cash flow.

Overview

Formerly known as Lulalend, Lula is a South African fintech focused on helping small and medium-sized businesses access unsecured finance without the red tape of traditional banks. The platform has grown to serve thousands of SMEs with products designed to solve short-term cash-flow challenges.

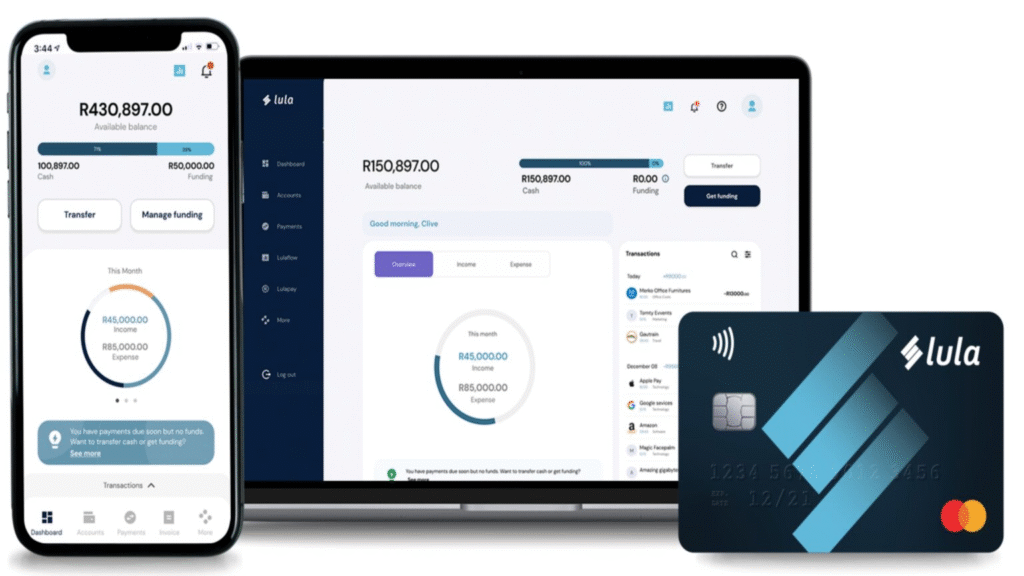

What sets Lula apart is its dual offer:

- Funding up to R5 million through two main products.

- A business bank account and card for better financial control.

This makes it not just a lender, but a full ecosystem designed around SME growth and resilience.

Features

- Funding up to R5,000,000.

- Two main products: Revolving Capital Facility and Capital Advance.

- Digital applications: Apply online, share read-only bank data, or upload statements.

- Speed: Decisions within minutes; funds often released in 24–48 hours.

- Unsecured loans: No assets required.

- Early-repayment benefits: Save money if you settle early.

- Banking integration: Business account and card for managing daily transactions.

- Sector flexibility: Retail, manufacturing, construction, hospitality, services — almost any SME with stable turnover.

Products

Revolving Capital Facility

Think of it as an overdraft without the bank bureaucracy. You draw when needed, repay, and redraw — all without starting a new application.

Capital Advance

A once-off cash injection with fixed monthly repayments over 3, 6, 9, or 12 months. You know the total cost upfront, and if you repay earlier, you save.

Pricing

Lula avoids compounding interest models. Instead:

- Capital Advances: One fixed fee agreed upfront. Repay early and pay less.

- Revolving Facility: Pay only on what you draw.

This transparency makes it easier for SMEs to budget and model repayments.

Example:

Borrow R200,000 for 6 months. If you settle in month 3, you won’t be charged for the remaining months. This makes early settlement genuinely rewarding.

User Base

Lula is built for established SMEs, not startups. The baseline requirements:

- Trading history: ~12 months minimum.

- Annual turnover: ~R500,000 or more.

- Location: South African-registered businesses.

- Docs required: Bank statements (3–6 months) or a secure link to your account.

Advantages

- Speed: Applications and approvals in hours, not weeks.

- Flexibility: Draw and repay capital as needed.

- Transparency: Fixed fees with no hidden costs.

- No collateral: Perfect for SMEs without heavy assets.

- Banking + funding integration: Everything in one place.

- Early repayment perks: Save money by settling sooner.

Disadvantages

- Higher cost than bank overdrafts: Speed and convenience come at a premium.

- Short terms: 3–12 months — not ideal for long-term capex.

- Eligibility threshold: Startups or businesses below R500k turnover may not qualify.

- Discipline needed: Easy access can tempt over-borrowing.

Safety & Trust

- Read-only bank data: No risk of unauthorized transactions.

- Compliance: POPIA-aligned, encrypted, and secured.

- Reputable partners: Banking services delivered with regulated partners.

- Fair practices: No early-settlement penalties.

How to Apply

- Start online. Provide basic business info.

- Share bank data. Securely link accounts or upload statements.

- Get a quote. View available amounts, terms, and fees.

- Accept & fund. Sign digitally, get money often within 24 hours.

- Manage & repay. Track through your dashboard, redraw when eligible.

Pro Tips:

- Keep personal and business accounts separate.

- Apply ahead of seasonal peaks.

- Use early settlement strategically to save costs.

Comparisons & Alternatives

- FundingHub: Aggregates 30+ lenders for comparison shopping.

- Bridgement: Flexible credit lines with flat monthly fees.

- Retail Capital / Merchant Capital: Turnover-based advances repaid as a slice of card sales.

- Banks: Slower, collateral-based, but often cheaper if approved.

- DFIs (IDC, SEFA, NEF): Better for long-term, asset-heavy projects.

When Lula wins: You need unsecured, fast, short-term capital with flexible redraws.

When banks win: You have time, collateral, and need the lowest possible cost.

Example Use-Cases

- Retailer prepping for festive season: Draw R750k, buy bulk stock at discount, repay in February, redraw for Easter.

- Construction contractor bridging progress payments: 6-month advance until milestone certificate clears.

- Service firm waiting on corporate clients: 3-month term to cover payroll while invoices age 60 days.

FAQs

- What products does Lula offer? Revolving Capital Facility and Capital Advance.

- How much can I borrow? Up to R5 million, depending on turnover and history.

- How fast is funding? Usually 24–48 hours.

- Do I need collateral? No, funding is unsecured.

- What terms are available? 3, 6, 9, or 12 months.

- Can I repay early? Yes, and you save by doing so.

- How are repayments structured? Fixed monthly instalments or pay-per-draw.

- Who qualifies? SA-registered SMEs with ~12 months history and R500k+ turnover.

- What docs do I need? 3–6 months’ bank statements or secure data link.

- Do sole proprietors qualify? Yes, if registered and meeting thresholds.

- Is it safe to share bank data? Yes, read-only access, no movement rights.

- What makes Lula different? Transparent pricing, fast approvals, early settlement benefits.

- How does it compare to banks? Faster, unsecured, but usually higher cost.

- Does Lula offer banking? Yes — a business account and card.

- Can I use it for equipment? Primarily for working capital, though short-term advances can bridge deposits.

Final Verdict

Lula is built for South African SMEs that value speed, clarity, and flexibility over rock-bottom cost. With funding limits up to R5 million, approvals in minutes, and funds often paid within a day, Lula is a lifeline for businesses managing tight cash-flow cycles. The combination of transparent fee-based pricing, early-repayment savings, and integrated banking makes it a modern solution for everyday working capital needs.

For SMEs that need to act fast, Lula delivers. It’s not for startups or long-term projects, but for established businesses chasing opportunities or smoothing out seasonal cycles, Lula turns uncertainty into confidence. Lula deserves a top spot on any SME’s funding shortlist.